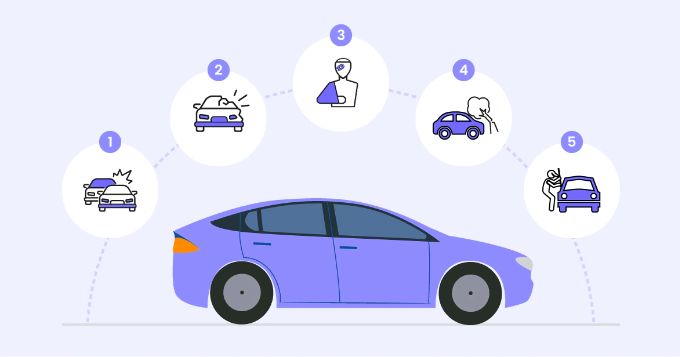

Navigating the auto insurance world can be overwhelming, especially with the various policies. Selecting the right option involves understanding what suits your needs; it’s about ensuring that you, your passengers, and your finances are safeguarded in an accident or unexpected event. This guide breaks down the different types to help you make informed decisions when exploring policies.

Why Auto Insurance Matters

Accidents, theft, or natural disasters can result in significant costs that are difficult to manage out of pocket. While looking for it, many drivers start by exploring auto insurance quotes to compare prices and benefits. Otherwise, you risk facing expenses for medical bills, vehicle repairs, or even lawsuits.

Beyond the financial aspect, the auto compensation plan offers emotional security. Whether it’s a minor fender bender or a significant accident, having the right policy will not put you in debt. This peace of mind is invaluable, making this a cornerstone of responsible driving.

Liability Coverage is a Legal Necessity

Liability insurance is often the foundation of any auto financial policy and is required in most states. It consists of two components:

- Bodily Injury Liability covers medical expenses and legal fees if you’re found responsible for injuring another person in an accident.

- Property Damage Liability helps pay for damages to another person’s property, such as their vehicle, mailbox, or home.

For instance, one state may mandate $25,000 in bodily injury liability per person, while another may require only $15,000. Meeting your state’s minimum requirements ensures you comply with the law, but relying solely on this plan might leave you financially vulnerable. A liability plan protects you financially if you’re at fault in an accident. However, it doesn’t cover your injuries or vehicle damage.

Collision Coverage Protecting Your Vehicle

Collision coverage covers the repair or replacement of your vehicle if it’s damaged in an accident, regardless of fault. Whether you hit another car, a pole, or a tree, this covers the repair bills. Although not legally required, a collision plan is often necessary if your car is financed or leased. It ensures you’re not left scrambling to pay for costly repairs after an accident.

Comprehensive Plan

This option covers damages caused by non-collision events, offering protection against scenarios such as theft, vandalism, natural disasters, or falling objects. For example, if a storm floods your car or a stray baseball cracks your windshield, comprehensive benefits cover you. This type of insurance is ideal for drivers who want more protection, especially those living in areas prone to extreme weather or high crime rates.

Uninsured and Underinsured Motorist Policy

Not everyone on the road carries adequate coverage or any at all. Uninsured and underinsured motorist plans protect you in these situations by covering your medical expenses and losses if you’re hit by a driver who doesn’t have enough money. This helps you to avoid or safeguard yourself from other people’s negligence at times. So, it’s crucial to get it to avoid hefty legal bills.

Medical Payments or Personal Injury Protection (PIP)

Medical payments (MedPay) and personal injury protection (PIP) policy help with medical expenses for you and your passengers after an accident, regardless of fault. MedPay covers hospital bills, surgery costs, and even funeral expenses. PIP offers broader protection, including lost wages, rehabilitation, and related fees. For families or individuals frequently driving with passengers, these policies provide an added layer of financial security.

Gap Insurance for Financed or Leased Cars

Gap insurance is a specialized option that covers the difference between your car’s current value and the amount you still owe on your loan or lease. If your car is totaled in an accident, standard policies typically only pay the vehicle’s market value, which can be significantly lower than the amount owed. For anyone financing or leasing a vehicle, this plan can prevent the monetary strain of paying out of pocket for a car you can no longer use.

Specialized Policy Options

For unique situations or preferences, there are additional types to consider:

- Roadside Assistance: Covers towing, jumpstarts, and other emergencies.

- Rental Reimbursement: Helps pay for a rental car while your vehicle is being repaired.

- Custom Equipment Insurance: Protects upgrades or custom parts added to your vehicle.

How Your Driving Habits Affect Auto Insurance Rates

Your driving habits are one of the key factors insurance providers consider when determining your premiums. Frequent long-distance driving or high annual mileage increases the likelihood of accidents, which can lead to higher rates. Conversely, low-mileage drivers may qualify for discounts since less time on the road reduces risk. Additionally, the times of day you drive can impact your insurance costs. Drivers who avoid peak traffic hours are often considered lower risk, as they are less likely to encounter heavy congestion or accidents.

A clean driving record is another critical aspect that significantly influences rates. Traffic violations, speeding tickets, and accident history can result in higher premiums, while safe drivers may qualify for programs offering discounts. By analyzing your driving patterns and comparing auto insurance quotes, you can make informed decisions that help lower your costs and secure a policy that fits your needs. Choose wisely, and drive with peace of mind knowing you’re covered.